Crypto staking is a process of holding cryptocurrencies to support the blockchain network and earning rewards for doing so. In this article, we will discuss what crypto staking is, how it works, and why it is becoming increasingly popular.

What is Crypto Staking?

Crypto staking is the process of holding a certain amount of cryptocurrency in a digital wallet to support the network’s operations. By doing so, users can earn rewards in the form of new cryptocurrency coins. The rewards are typically proportional to the amount of cryptocurrency that is being staked.

How Does Crypto Staking Work?

Crypto staking works by using Proof of Stake (PoS) consensus algorithms. In a PoS network, users can participate in the consensus process by staking their cryptocurrency holdings to validate transactions and secure the network. Validators are chosen randomly, and the more cryptocurrency a user stakes, the higher the chance they will be selected as a validator. Validators are responsible for verifying transactions and adding them to the blockchain, and they earn rewards for doing so.

Benefits of Crypto Staking

There are several benefits to crypto staking, including:

Passive Income

Crypto staking allows users to earn passive income by holding their cryptocurrency in a digital wallet.

Lower Energy Consumption

Compared to Proof of Work (PoW) consensus algorithms, which require significant computing power, PoS algorithms require much less energy consumption, making them more environmentally friendly.

Network Security

By staking cryptocurrency, users can help secure the network and prevent fraudulent activities such as double-spending.

Network Participation

Crypto staking allows users to participate in the network and have a say in the consensus process.

Challenges of Crypto Staking

Despite its benefits, crypto staking also comes with some challenges, including:

Volatility

The value of cryptocurrency is highly volatile, which means that the rewards earned from staking can fluctuate significantly.

Technical Requirements

Crypto staking requires technical knowledge and skills to set up and manage the digital wallet and staking process.

Risk of Loss

There is always a risk of loss when holding cryptocurrency, and users should carefully evaluate the risks before staking their holdings.

Popular Crypto Staking Coins

Some of the most popular cryptocurrencies for staking include:

Ethereum (ETH)

Ethereum is one of the most popular cryptocurrencies for staking, with a PoS consensus algorithm called Ethereum 2.0.

Cardano (ADA)

Cardano is another popular cryptocurrency for staking, with a PoS consensus algorithm called Ouroboros.

Polkadot (DOT)

Polkadot is a newer cryptocurrency that allows users to stake their holdings to secure the network and earn rewards.

How to Start Crypto Staking?

If you are interested in crypto staking, here are the steps you can take to get started:

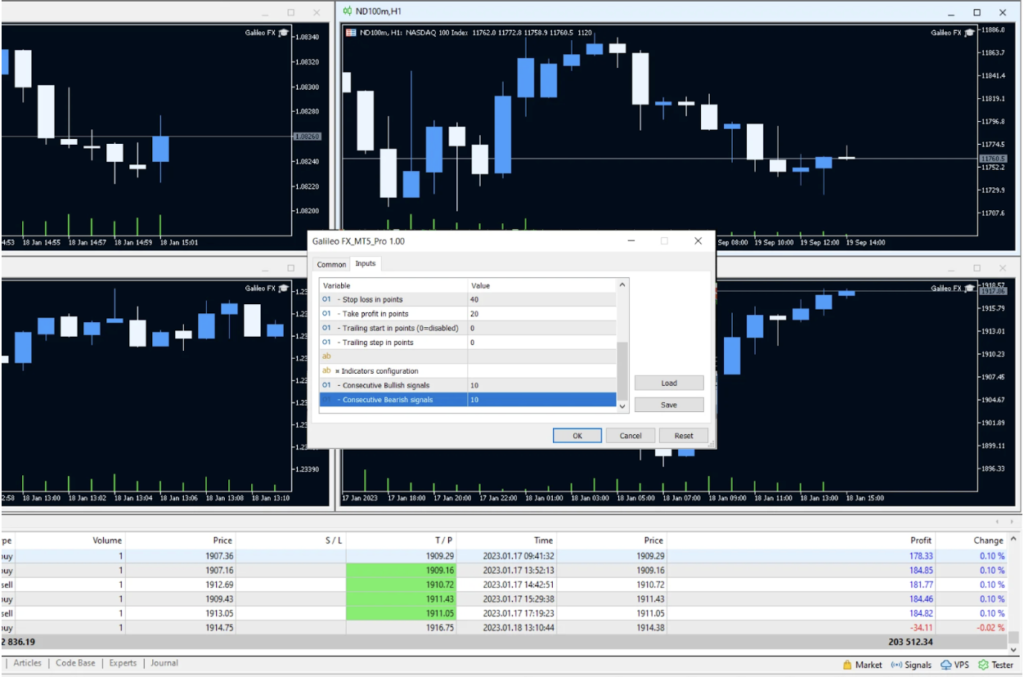

Choose a Staking Coin

The first step is to choose a cryptocurrency to stake. Consider factors such as the coin’s market value, staking rewards, and reputation.

Set Up a Digital Wallet

You will need to set up a digital wallet that supports staking for your chosen cryptocurrency. Make sure to choose a reputable wallet with strong security features.

Buy Cryptocurrency

If you don’t already own the cryptocurrency you want to stake, you will need to buy it. You can purchase it from a cryptocurrency exchange using fiat currency or other cryptocurrencies.

Transfer Cryptocurrency to Your Wallet

Once you have purchased the cryptocurrency, transfer it to your staking wallet.

Start Staking

Follow the instructions provided by your staking wallet to start staking your cryptocurrency. Make sure to understand the staking requirements and rewards before committing your holdings.

Staking Pools

Staking pools are a popular option for users who want to participate in staking but may not have enough cryptocurrency to meet the minimum staking requirements. In a staking pool, users pool their cryptocurrency holdings and earn rewards proportionally based on their contribution to the pool.

Risks of Crypto Staking

As with any investment, crypto staking comes with risks. The value of cryptocurrency is highly volatile, and the rewards earned from staking can fluctuate significantly. There is also the risk of loss if the cryptocurrency value drops. Additionally, staking requires technical knowledge and skills, and users need to be aware of the risks and challenges before staking their holdings.

Crypto Staking and DeFi

Crypto staking is also closely linked to the decentralized finance (DeFi) movement. DeFi refers to a new financial system built on blockchain technology that aims to be more open, transparent, and accessible than traditional finance. Many DeFi protocols are built on PoS consensus algorithms and rely on staking to secure the network and incentivize participation.

DeFi staking allows users to earn rewards by staking their cryptocurrency in DeFi protocols such as lending and borrowing platforms, decentralized exchanges, and yield farming protocols. Staking is a critical component of many DeFi protocols, as it helps to secure the network and incentivize participation, which is crucial for the success of the DeFi ecosystem.

Stablecoin Staking

Another form of crypto staking is stablecoin staking. Stablecoins are cryptocurrencies that are pegged to a stable asset such as the US dollar, which helps to reduce volatility. Stablecoin staking allows users to earn rewards by staking their stablecoins in platforms such as lending and borrowing protocols. Stablecoin staking is a popular option for users who want to earn passive income without the volatility of traditional cryptocurrencies.

Future of Crypto Staking

As the cryptocurrency market continues to evolve, crypto staking is likely to become an even more popular investment option for users. With the rise of DeFi, stablecoin staking, and other innovative applications of blockchain technology, there is significant potential for crypto staking to become a mainstream investment option.

Moreover, with the introduction of Ethereum 2.0, which is expected to fully transition to a PoS consensus algorithm, the importance and popularity of crypto staking are expected to grow even further.

Conclusion

Crypto staking is an innovative way for users to support blockchain networks and earn rewards for doing so. While it comes with risks and challenges, it also offers benefits such as passive income and network participation. By following best practices and carefully evaluating the risks and rewards, users can make informed decisions about whether to participate in crypto staking. As the cryptocurrency market continues to evolve, crypto staking is likely to become an even more popular investment option for users.