July 22, 2022– IMC intends to give new ideas and technical support for the OTC fintech market in the areas of self-discipline mechanism development and data supervision support via intelligent quantitative trading. The purpose of IMC is to promote self-discipline and autonomy processes. The IMC system is structured in such a way that any user can build contract templates and transaction contracts at ease.

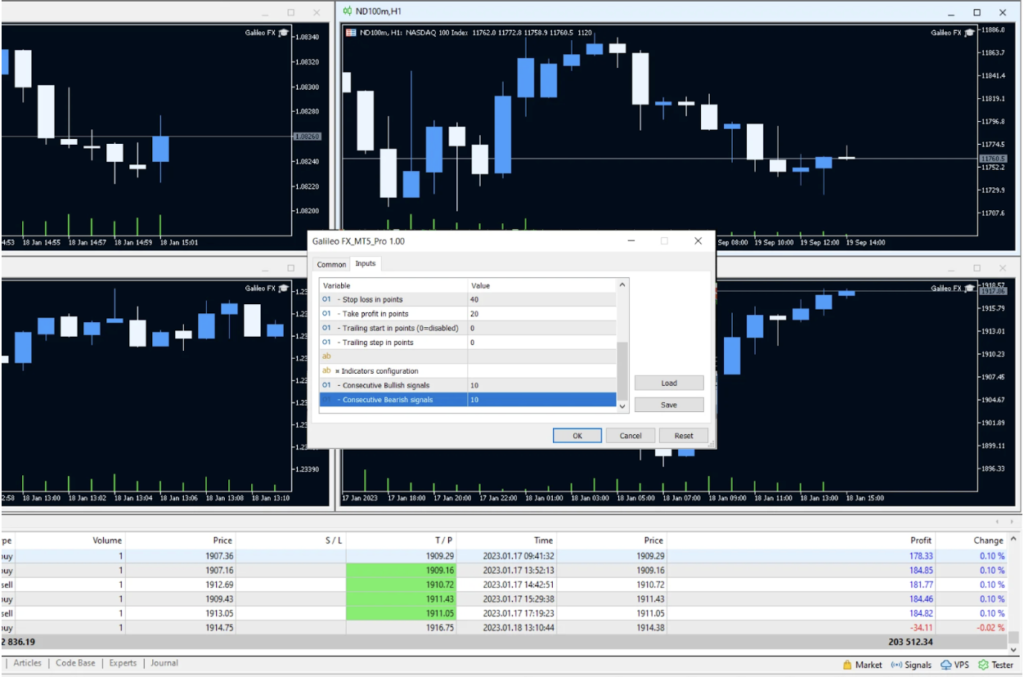

The IMC ecosystem utilizes High Frequency Trading, a type of quantitative trading recognized for its speed. It uses advanced computer technology to process transactions in milliseconds and holds positions for a brief period of time during the day. By gathering and processing transaction by transaction data, high frequency trading assesses the market's possible trading possibilities at the micro level.

The ecosystem also uses another type of quantitative trading known as Trend Trading, which demonstrates how the market follows trends. According to the trend theory, once the market has created a downward (or upward) trend, it will continue in that direction. According to trend theory, there are three types of trends in digital currency price movement, the most important of which is the basic trend of digital currency, which is a change in currency price that increases or decreases extensively or thoroughly.

The IMC platform has also developed a powerful income system that can provide far more income to investors than other quantitative ecosystems. The IMC quantification system contains a static and dynamic income model, which necessitates the purchase of products with a static income of more than 60 days. This model has five levels, and investors can work together to get larger profits.

It is worth noting that a minimum investment of 100 USDT is required for users to begin investing. Users can join hands to form a team, and the team will be assigned a distinct VIP level based on its overall capital volume. The first level is VIP1 where the capital volume is between 100 USDT and 19999 USDT, the team advances to VIP2 when the capital volume is between 20000USDT and 100000USDT, and so on. When the capital volume reaches a predetermined level, the team can advance to the next level, and users can enjoy the corresponding level's income (for example, VIP2 is 7 percent, VIP3 is 10 percent).

However, each VIP level team has a maximum investment amount for a single investor at this level. A single investor in a VIP1 team, for example, has a weekly investment limit of 5,000 USDT, whereas a single investor in a VIP2 team has a weekly investment limit of 10,000 USDT. IMC encourages other users to participate in order to prevent a single user from amassing an excessive amount of capital.

According to a member of the core team, "our expertise in cross capital structure investment enables us to cultivate a diversified portfolio of global investment strategies in the following four categories: quantitative strategies, Web3.0, funds, and AI learning systems." For investing in these asset classes, we emphasize opportunism, value orientation, and risk control methods. IMC has a $8.65 billion asset management scale and is committed to investing in emerging technologies and artificial intelligence."

IMC also offers users simple, convenient, and secure payment and transaction services via its proprietary cross-border payment and micropayment network, as well as integration with various exchange APIs.

4 comments